TITLE:

Why Dunzo Has Decline..! What Happened..?

CATEGORY : BUSINESS

CONTENT:

What makes a successful company….? Is it being a first mover in a massive market, is it raising 100s of millions of dollars, or is it having a Billion dollar valuation, and finally being so popular, that you become a verb to your customers? The startup which we are discussing today has all of these. It was one of the India’s hyperlocal delivery market, the startup has raised close to half a billion dollars in funding. We will be talking about the journey of Dunzo, how a startup that had it all, is now on the verge of shutting down, two of its co-founders have quit, employees haven’t received salaries for the last six months and the company is now facing legal notices by other companies for its pending dues. All of this and more in this article of Backstage With Millionaires. How Dunzo Start’sGrowth of Dunzo:First Wrong Step dunzo had made:The Reliance’s DealWhat we learn from it..? How Dunzo Start’s Dunzo was started 2014 at a time when city life in India looked very different. There was no concept of hyperlocal delivery, in fact, getting your food delivered was a novelty for Indians. Zomato had started delivering food in the same year and Swiggy was still figuring out the first version of its app. Kabeer Biswas was 30 years old at this time and had seen little success with this first startup. His first startup Hoppr, was a location-based coupon service, think of it like Groupon without the Internet. It was based on SMS. It was eventually bought out by Hike. And this gave him some time to sit back and think about his next idea, which came out from one of his problems. He was inspired by Uber and thought of an app that could get everything done for you with just one click. He pitched this idea to his friends, three of whom became his co-founders. Dunzo started as a What’sapp group, where people would text what they needed to get done, and Kabeer would do it himself in the early days. Sometimes from 5 AM in the morning to 1 AM in the night. Growth of Dunzo: During one of these Whatsapp deliveries, Kabeer ended up delivering an order to Sahil Kini of Lightrock, who ended up becoming their first investor. After receiving the funds, it's grew quickly. In the next six years, their monthly orders went from just 15,000 in 2016 to over 2 million by 2021. That’s more than 130X growth. But this growth came at a cost. And if you look at their financials closely, you will see the problem. See, Dunzo had made just 88 crore rupees in revenue between the financial year of 2018 to 2021. But their losses had crossed 750 crore rupees. Basically, Dunzo was losing 7.5 rupees for every rupee it was earning in revenue. Their sole focus at this time was to gain more subscribers. First Wrong Step dunzo had made: The year 2020 changed Indian hyperlocal delivery in a big way. Dunzo’s active users almost doubled from 2.7 million in 2019 to 5.1 million in 2020. But that was not all. Their financials were finally taking a turn for the good, For the first time since 2018 to the financial year of 2021, Dunzo’s losses had actually shrunk while their revenue continued to grow. But right at that moment, Dunzo sensed a new opportunity. Quick commerce and It was a billion-dollar opportunity and Dunzo was in the perfect place to adopt this new delivery model. They had a massive customer base and they had delivery partners. In fact, they raised a massive funding round worth 40 Million dollars during this time and launched Dunzo Daily to capitalise on this opportunity. But somewhere down the road, this new shiny opportunity became the first reason for Dunzo’s failure. You see, quick commerce needs a very different infrastructure. With hyperlocal delivery, Dunzo was simply picking up stuff from neighbourhood shops and delivering them to their customers. It was a simple business. But the entire quick commerce model runs on ‘Dark Store’ model where you open a dark store in high-density areas so that you can deliver the goods in the shortest time possible. This means they had to spend tons of money to add hundreds of these dark stores or warehouses when they had still not managed to turn their hyperlocal business profitable. But Dunzo wasn’t the only one going after the quick commerce market. Swiggy’s Instamart, Zomato’s Blinkit, Tata’s BigBasket and Zepto were all going after the same market which quickly became overcrowded. Dunzo lost its ‘exclusive’ factor as soon as they moved into this space. Then there was another factor where Dunzo was lagging behind, Money. Unlike Dunzo, their competitors had so much more in the bank and big names to fund their rapid growth and corner this emerging market. That’s exactly what happened. Between FY20 and FY23, Dunzo had raised a little over 400 million dollars and used up almost all of it to open around 130 dark stores but in spite of that their market share in the quick commerce segment was negligible. Just look at this graph. Almost, all of the quick commerce market is distributed between the top 4 - Swiggy’s Instamart, Zomato’s Blinkit, Zepto and BigBasket. While trying to compete in the quick commerce space, not only had Dunzo run out of money but ended up committing suicide in early 2022, when they raised a 240 million funding round led by Reliance. Even though, they didn’t know it at the time. The Reliance’s Deal See, Dunzo was desperate and they needed cash if they were going to have any chance of beating these quick commerce giants like Swiggy’s Instamart, Zomato’s Blinkit, Tata’s BigBasket and Zepto. Reliance came as a saviour and took almost 26% stake in Dunzo for their 200 million dollars. But there was a catch, By acquiring 26% stake, Reliance was able to get veto powers against any big decisions in the company like: share issues or acquisitions. this meant that in future dunzo could not take any big decision without reliance approval that’s exactly what happened when dunzo decided to raise the next funding round reliance simply refused, overvaluation disagreement. Photo Credit:THE ARC Things only went from bad to worse when the 2 of Dunzo’s co-founders decided to jump the ship. Currently, Dunzo is trying everything to survive. There are reports that they’ve shut down their quick commerce business across every major city except for Bengaluru. In Bengaluru, they still have 7 dark stores operational. But for the most part, Dunzo has gone back to the hyperlocal delivery model and given up on their quick commerce dreams. They’ve even given up their Bengaluru office. But the fact is none of this might be enough for Dunzo to survive. Their monthly burn is over 100 Crore Rs and according to a report, they have less than 500 crore in the bank, which means unless they raise money soon, they will have to shut down. So, what can we learn from Dunzo’s mistakes? What we learn from it..? I think the lessons are pretty clear. Don’t lose your USP. Don’t pivot at the cost of your differentiator or USP, which is unique value proposition”. See, Dunzo was the king of hyperlocal. It became a verb to people. Everyone knew them. But when they moved into quick commerce, they got lost in the crowd. They lost their edge. Next lesson is - that you should first be operationally profitable in your core business before you venture out into new business segments. Take the example of edtech. Startups like Unacademy had expanded into everything from test preparation to K-12 coaching. But as their revenue grew, so did their losses and now. Unacademy is going back to its core business and shutting down business segments that failed to find a product market fit. Building a sustainable core business can then fund your new ventures. Finally, when you are going up against heavily funded companies, you need to make sure you have the right investors and VCs in your corner, whose interest align with yours. While, Instamart had Swiggy, Blinkit had Zomato, and Zepto had huge US-based VCs and investors like the StepStone Group, Y Combinator and Goodwater Capital, Dunzo didn’t have a partner like that. In desperation, they had to raise money from Reliance, which is more of a strategic investor with its own agenda instead of the company’s growth.

What makes a successful company….? Is it being a first mover in a massive market, is it raising 100s of millions of dollars, or is it having a Billion dollar valuation, and finally being so popular, that you become a verb to your customers? The startup which we are discussing today has all of these. It was one of the India’s hyperlocal delivery market, the startup has raised close to half a billion dollars in funding.

We will be talking about the journey of Dunzo, how a startup that had it all, is now on the verge of shutting down, two of its co-founders have quit, employees haven’t received salaries for the last six months and the company is now facing legal notices by other companies for its pending dues. All of this and more in this article of Backstage With Millionaires.

Table of Contents

How Dunzo Start’s

Dunzo was started 2014 at a time when city life in India looked very different. There was no concept of hyperlocal delivery, in fact, getting your food delivered was a novelty for Indians. Zomato had started delivering food in the same year and Swiggy was still figuring out the first version of its app. Kabeer Biswas was 30 years old at this time and had seen little success with this first startup.

His first startup Hoppr, was a location-based coupon service, think of it like Groupon without the Internet. It was based on SMS. It was eventually bought out by Hike. And this gave him some time to sit back and think about his next idea, which came out from one of his problems. He was inspired by Uber and thought of an app that could get everything done for you with just one click. He pitched this idea to his friends, three of whom became his co-founders.

Dunzo started as a What’sapp group, where people would text what they needed to get done, and Kabeer would do it himself in the early days. Sometimes from 5 AM in the morning to 1 AM in the night.

Growth of Dunzo:

During one of these Whatsapp deliveries, Kabeer ended up delivering an order to Sahil Kini of Lightrock, who ended up becoming their first investor. After receiving the funds, it’s grew quickly. In the next six years, their monthly orders went from just 15,000 in 2016 to over 2 million by 2021. That’s more than 130X growth. But this growth came at a cost. And if you look at their financials closely, you will see the problem.

See, Dunzo had made just 88 crore rupees in revenue between the financial year of 2018 to 2021. But their losses had crossed 750 crore rupees. Basically, Dunzo was losing 7.5 rupees for every rupee it was earning in revenue. Their sole focus at this time was to gain more subscribers.

First Wrong Step dunzo had made:

The year 2020 changed Indian hyperlocal delivery in a big way. Dunzo’s active users almost doubled from 2.7 million in 2019 to 5.1 million in 2020. But that was not all. Their financials were finally taking a turn for the good, For the first time since 2018 to the financial year of 2021, Dunzo’s losses had actually shrunk while their revenue continued to grow. But right at that moment, Dunzo sensed a new opportunity.

Quick commerce and It was a billion-dollar opportunity and Dunzo was in the perfect place to adopt this new delivery model. They had a massive customer base and they had delivery partners. In fact, they raised a massive funding round worth 40 Million dollars during this time and launched Dunzo Daily to capitalise on this opportunity. But somewhere down the road, this new shiny opportunity became the first reason for Dunzo’s failure.

You see, quick commerce needs a very different infrastructure. With hyperlocal delivery, Dunzo was simply picking up stuff from neighbourhood shops and delivering them to their customers. It was a simple business. But the entire quick commerce model runs on ‘Dark Store’ model where you open a dark store in high-density areas so that you can deliver the goods in the shortest time possible.

This means they had to spend tons of money to add hundreds of these dark stores or warehouses when they had still not managed to turn their hyperlocal business profitable. But Dunzo wasn’t the only one going after the quick commerce market. Swiggy’s Instamart, Zomato’s Blinkit, Tata’s BigBasket and Zepto were all going after the same market which quickly became overcrowded. Dunzo lost its ‘exclusive’ factor as soon as they moved into this space.

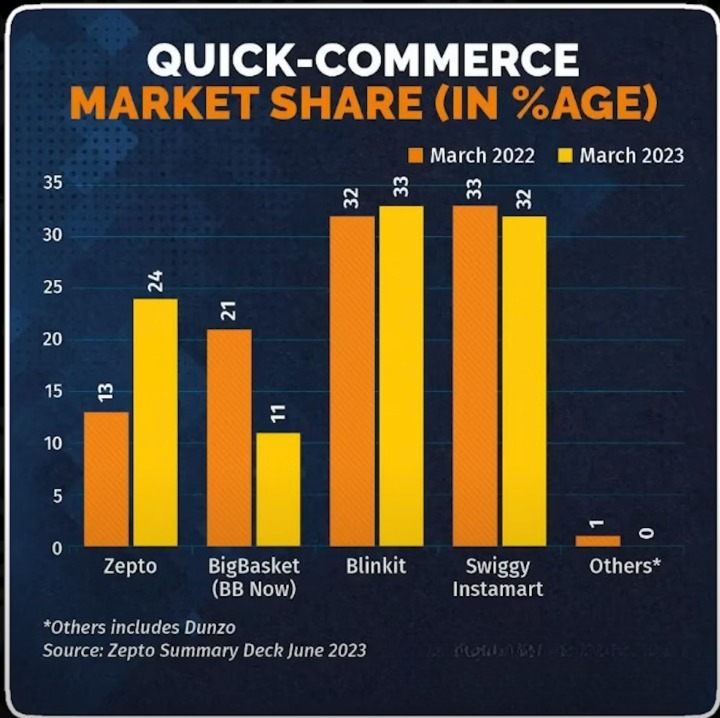

Then there was another factor where Dunzo was lagging behind, Money. Unlike Dunzo, their competitors had so much more in the bank and big names to fund their rapid growth and corner this emerging market. That’s exactly what happened. Between FY20 and FY23, Dunzo had raised a little over 400 million dollars and used up almost all of it to open around 130 dark stores but in spite of that their market share in the quick commerce segment was negligible. Just look at this graph.

Almost, all of the quick commerce market is distributed between the top 4 – Swiggy’s Instamart, Zomato’s Blinkit, Zepto and BigBasket. While trying to compete in the quick commerce space, not only had Dunzo run out of money but ended up committing suicide in early 2022, when they raised a 240 million funding round led by Reliance. Even though, they didn’t know it at the time.

The Reliance’s Deal

See, Dunzo was desperate and they needed cash if they were going to have any chance of beating these quick commerce giants like Swiggy’s Instamart, Zomato’s Blinkit, Tata’s BigBasket and Zepto. Reliance came as a saviour and took almost 26% stake in Dunzo for their 200 million dollars. But there was a catch, By acquiring 26% stake, Reliance was able to get veto powers against any big decisions in the company like: share issues or acquisitions.

this meant that in future dunzo could not take any big decision without reliance approval that’s exactly what happened when dunzo decided to raise the next funding round reliance simply refused, overvaluation disagreement.

Things only went from bad to worse when the 2 of Dunzo’s co-founders decided to jump the ship. Currently, Dunzo is trying everything to survive. There are reports that they’ve shut down their quick commerce business across every major city except for Bengaluru.

In Bengaluru, they still have 7 dark stores operational. But for the most part, Dunzo has gone back to the hyperlocal delivery model and given up on their quick commerce dreams. They’ve even given up their Bengaluru office. But the fact is none of this might be enough for Dunzo to survive.

Their monthly burn is over 100 Crore Rs and according to a report, they have less than 500 crore in the bank, which means unless they raise money soon, they will have to shut down. So, what can we learn from Dunzo’s mistakes?

What we learn from it..?

I think the lessons are pretty clear. Don’t lose your USP. Don’t pivot at the cost of your differentiator or USP, which is unique value proposition”. See, Dunzo was the king of hyperlocal. It became a verb to people. Everyone knew them. But when they moved into quick commerce, they got lost in the crowd. They lost their edge.

Next lesson is – that you should first be operationally profitable in your core business before you venture out into new business segments. Take the example of edtech. Startups like Unacademy had expanded into everything from test preparation to K-12 coaching. But as their revenue grew, so did their losses and now.

Unacademy is going back to its core business and shutting down business segments that failed to find a product market fit. Building a sustainable core business can then fund your new ventures. Finally, when you are going up against heavily funded companies, you need to make sure you have the right investors and VCs in your corner, whose interest align with yours. While, Instamart had Swiggy, Blinkit had Zomato, and Zepto had huge US-based VCs and investors like the StepStone Group, Y Combinator and Goodwater Capital, Dunzo didn’t have a partner like that. In desperation, they had to raise money from Reliance, which is more of a strategic investor with its own agenda instead of the company’s growth.